Moving can be an overwhelming task, but choosing reliable and professional movers in Burlington can alleviate much of the stress involved. Whether you’re moving across town or across the country, it’s crucial to select a moving company that is trustworthy and capable of handling your valuable belongings.

Read moreDo Movers Pack Your Clothes?

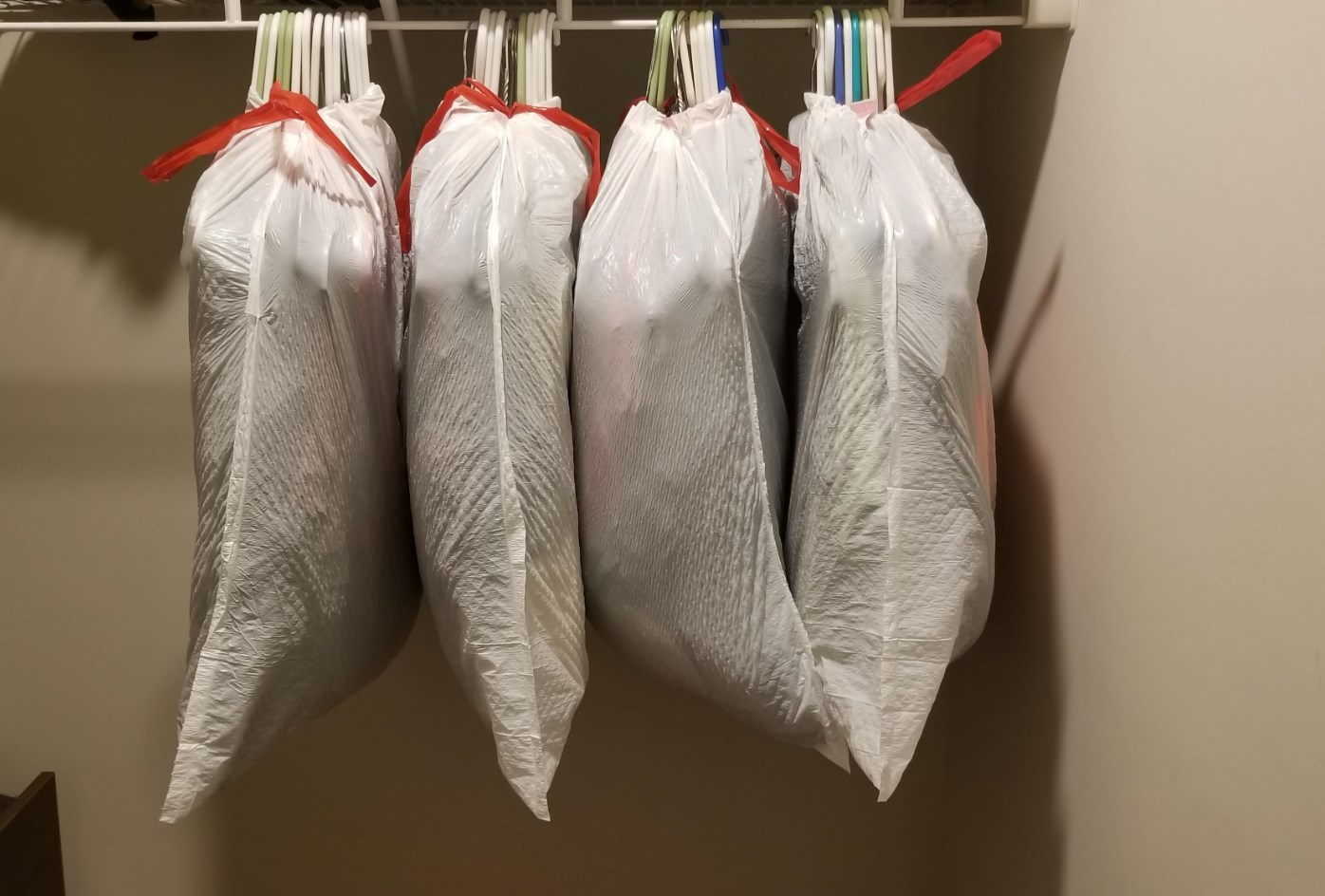

That’s why many people choose to hire Toronto movers to help them with the process. But, one of the questions that often come to mind is whether or not the movers will pack their clothes. In this article, we’ll explore the different options for packing clothes during a move and answer some common questions about the process.

Read more10 Things To Arrange When Moving House

Moving house can be an exciting and daunting experience at the same time. With so much to do, it’s easy to feel overwhelmed. From packing to finding the right moving company, there are several things that you need to arrange before the big day arrives. In this article, we’ll be discussing the top 10 things…

Read moreHow To Create Your Own Packing System For Moving

Moving can be a stressful and overwhelming experience, especially when it comes to packing your belongings. With so many items to sort, wrap, and pack, it can be challenging to know where to start and how to ensure that everything arrives safely at your new home. However, with a well-planned packing system, you can streamline…

Read moreHow To Make Moving Easier For a Child

Moving can be a daunting task for anyone, but it can be particularly challenging for children. Not only are they leaving behind friends and familiar surroundings, but they may also feel like they have no control over the situation. As a parent, it’s important to help your child through the moving process and make it…

Read more5 Tips For Moving Into a Retirement Home

As you prepare to move into a retirement home, you may be feeling overwhelmed by the changes that lie ahead. Whether you are downsizing from a family home or moving from a smaller apartment, it is important to plan your move carefully to ensure a smooth transition. In this article, we will explore five tips…

Read moreHow To Disassemble a Bed Frame For Moving

Moving to a new house can be an exciting experience, but it can also be stressful and time-consuming. One of the most challenging parts of moving is disassembling your furniture, especially your bed frame. Disassembling a bed frame can be tricky if you don’t know what you’re doing. However, with the right tools and a…

Read more